Onboard Customers Instantly.

Stay 100% Compliant.

Onboard customers in minutes—not days. Stay 100% compliant with RBI, CERSAI & UIDAI regulations while delivering frictionless digital experiences.

Trusted by Forward-Looking BFSI Institutions

Measurable ROI with every onboarded customer

Faster Onboarding

Reduced Manual Intervention

Error Reduction

Regulatory Coverage

Trusted By Leading Financial Institutions

Why BFSI Leaders Choose iStart

100% RBI, CERSAI & UIDAI Compliant

Stay audit-ready with real-time validation against RBI, CERSAI and UIDAI protocols.

Faster Customer Onboarding

Reduce onboarding time from days to minutes with automated data capture, KYC checks, and instant verifications.

Omnichannel Integration

Seamlessly onboard via Web, Mobile, Assisted Branch Modes.

Intelligent Document Processing

OCR & AI-powered parsing of Aadhaar, PAN, GST, DL, and more.

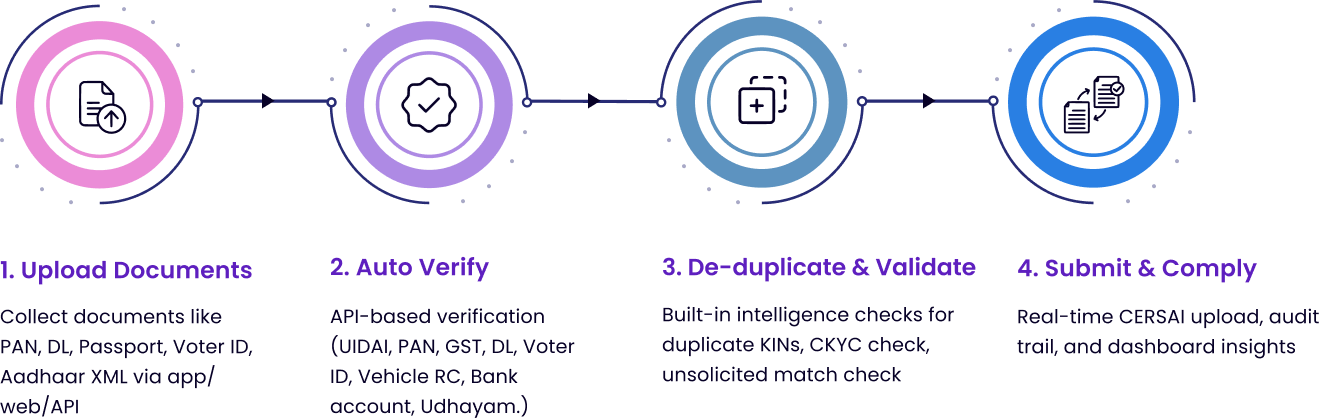

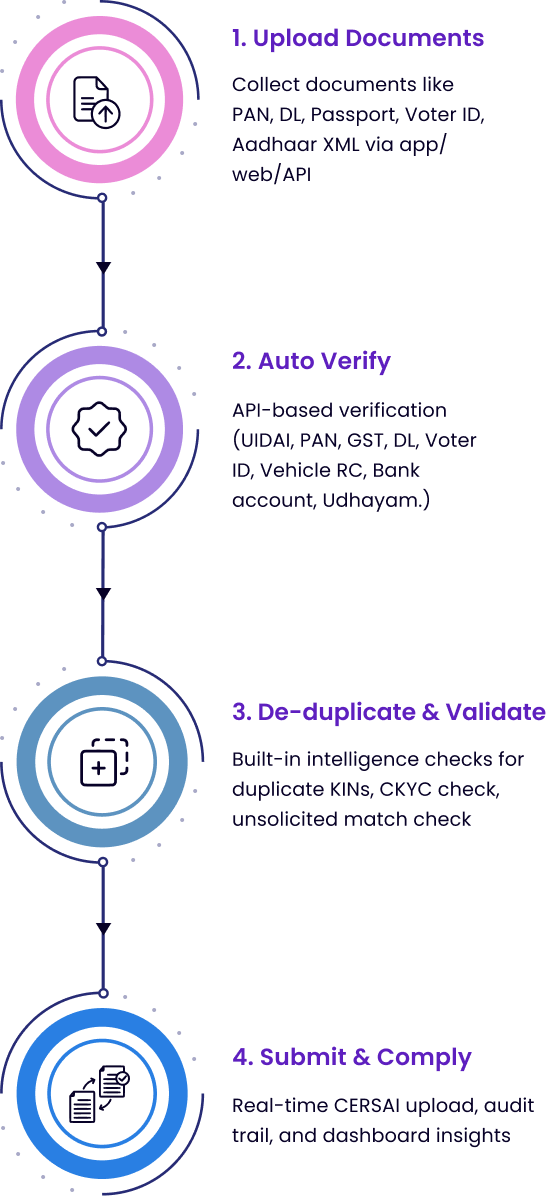

Customer Onboarding in 4 Simple Steps

Purpose-Built for Banks, NBFCs, Insurance & Fintechs

iStart combines high grade automation with built in compliance for seamless digital onboarding

- Real-time data validation

- Seamless EKYC & CKYC processing

- Aadhaar Offline XML & Masking integration

- API-based CERSAI & UIDAI checks

- V-CIP, eSign & OTP-based authentication

- Auto-formatting & validation of KYC documents

- Instant KYC number retrieval and deduplication

- 100% In-House Built Zero External Dependencies

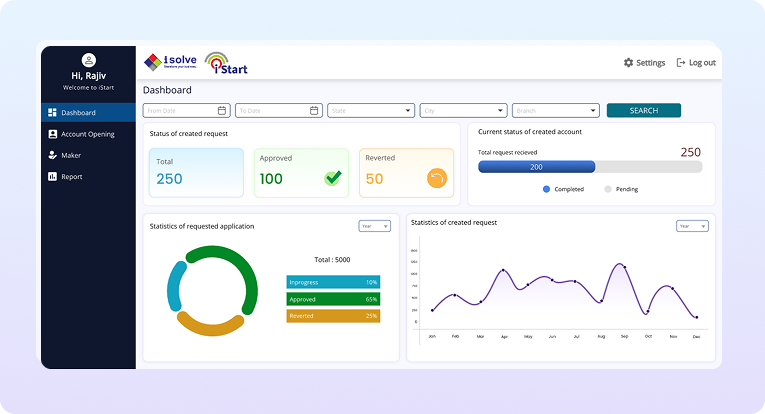

All in One Digital Onboarding Platform

Replace fragmented onboarding flows with a unified solution that ensures speed, accuracy, and compliance

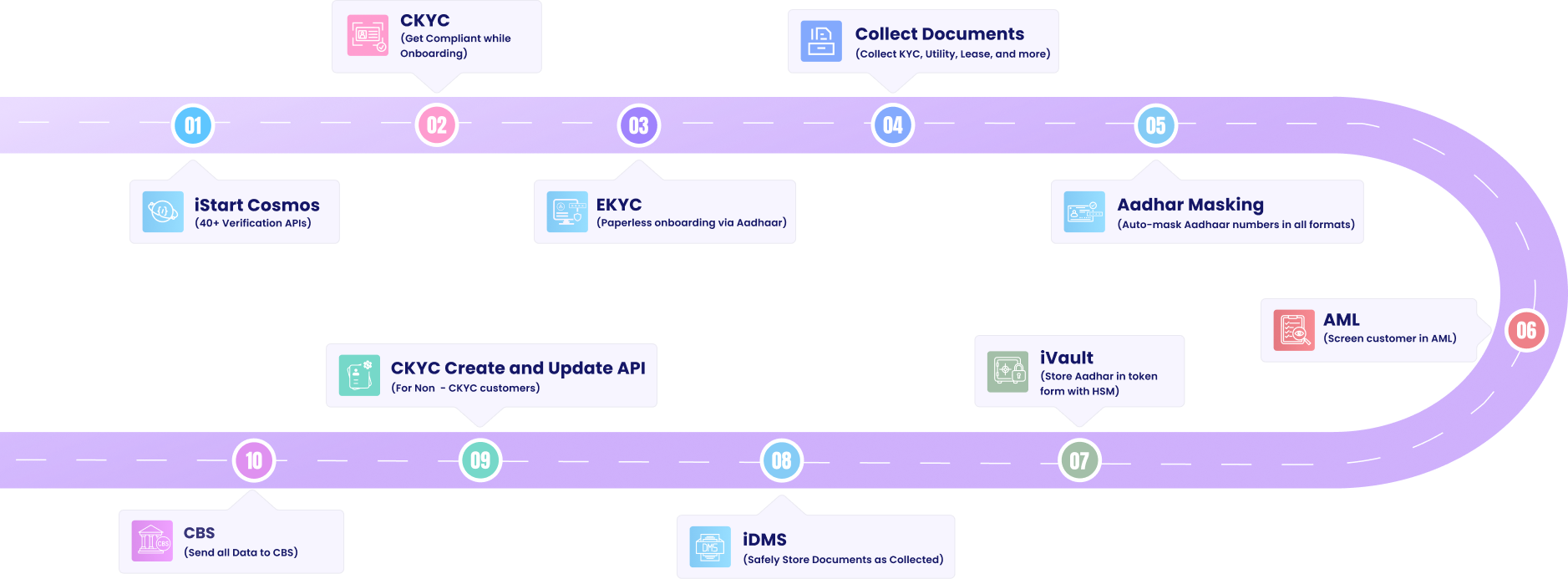

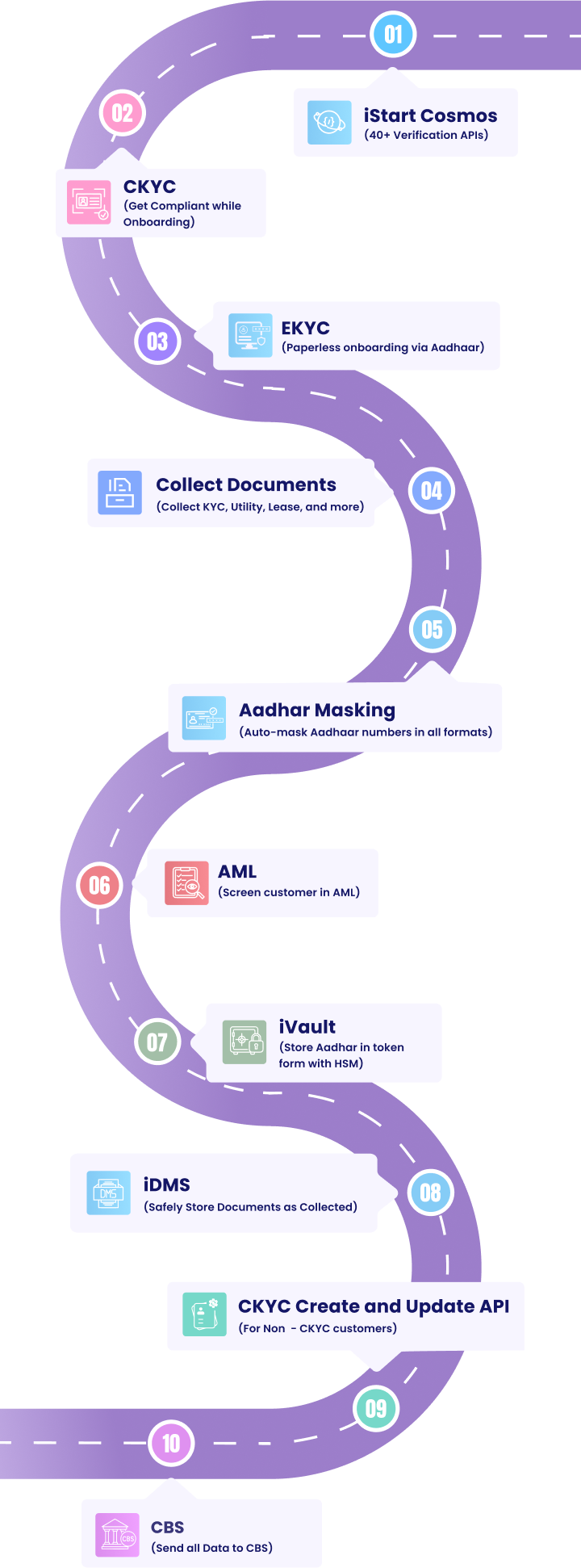

End to End Digital Onboarding with 100% Compliance within iSolve Universe

Omni Channel 360 degree process: Branch | Web | Mobile | Tab | VKYC

Built to meet the guidelines

from RBI, UIDAI, IRDAI, SEBI,

CERSAI, etc.

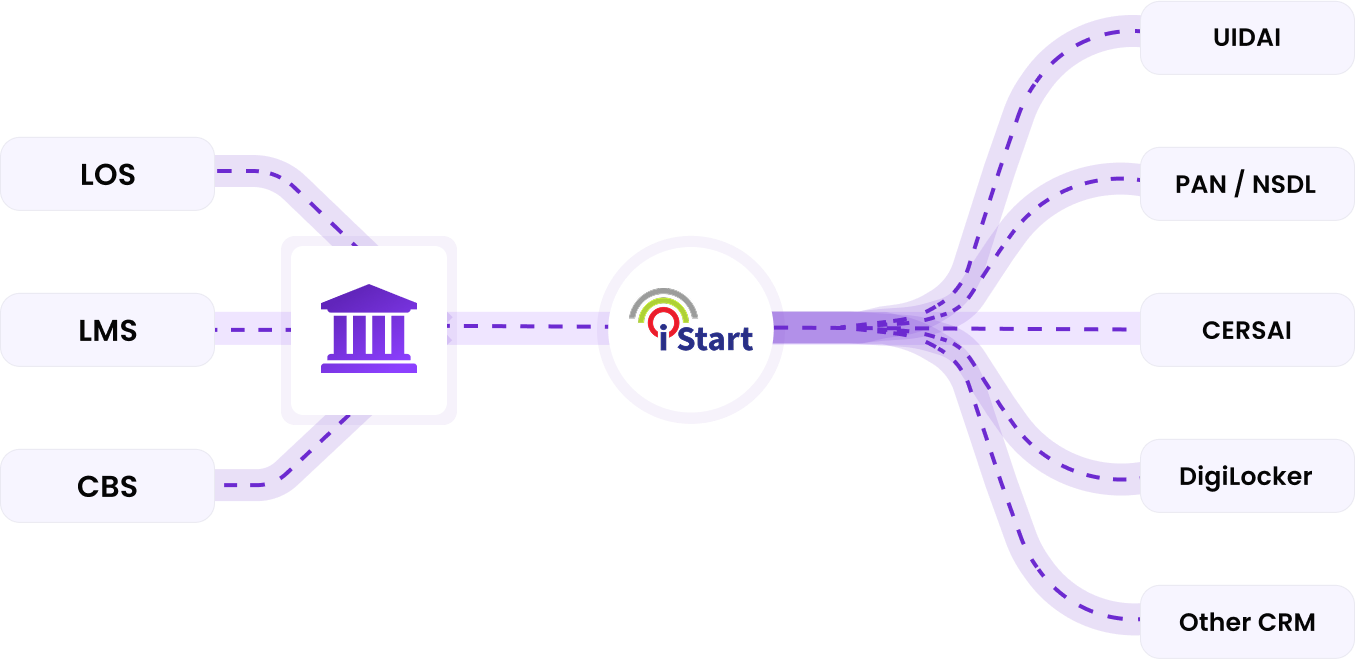

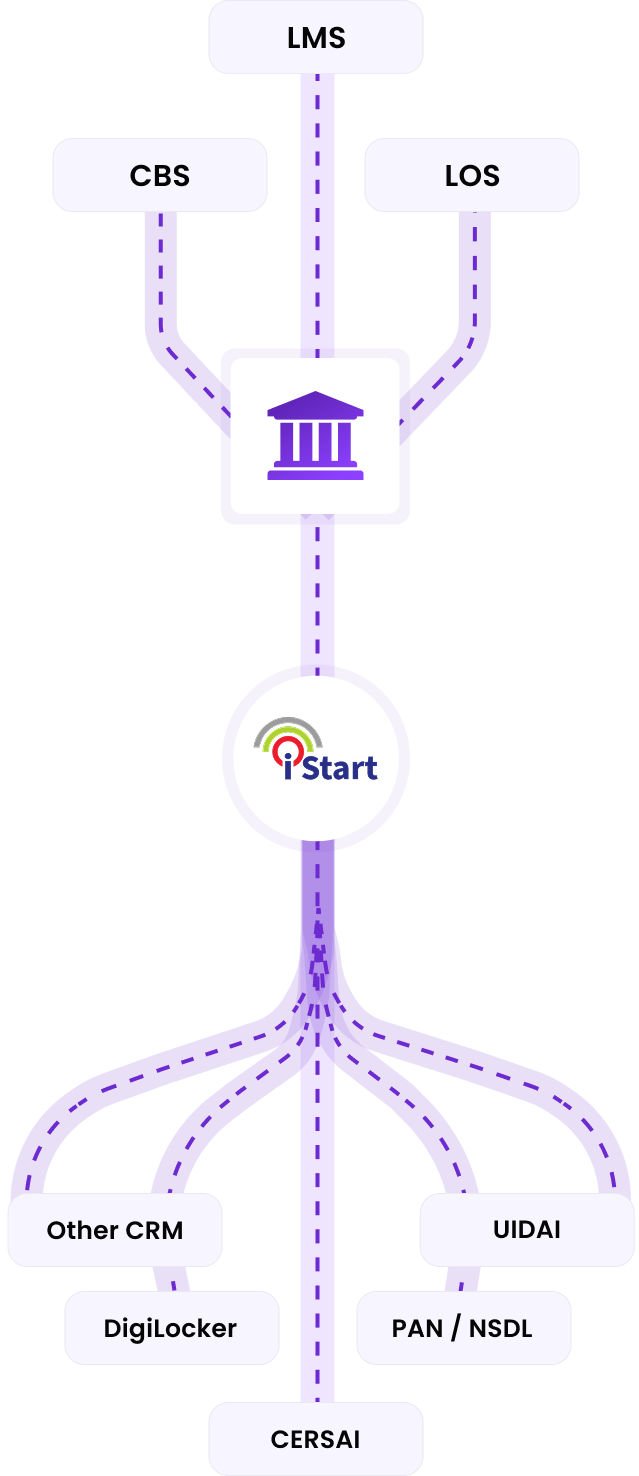

Connect iStart with Everything You Use

Our platform integrates with your LOS, LMS, CRMs, and government APIs

Book Your Free Demo Today

Let s help you digitize customer onboarding with compliance at its core.

About iSolve

We are a Global Business Transformation company having 20 years of expertise in helping BFSI, NBFC, and other financial services with our best-in-breed Reg Tech application platform. We partner with our customers, understand their business, hypothesize and analyze process gaps, build strategy and bring 100% visibility to every step of the operation with innovative technology.

Schedule a Demo for Digital Onboarding with KYC Solutions!

Get your free demo and discover how we help BFSI leaders onboard securely, remotely, and faster than ever.

Get your free demo and discover how we help BFSI leaders onboard securely, remotely, and faster than ever.